Don't have home insurance? This is why you should get it

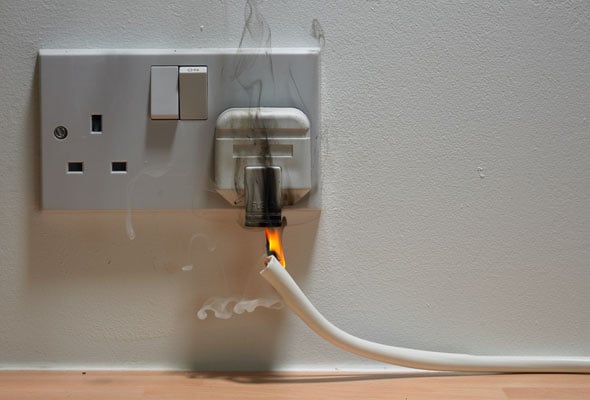

Yesterday’s fire in Dubai Marina has left residents displaced, anxious, and possibly out of pocket when it comes to damage – and it’s not the first apartment-block fire in recent times. So, should we all be signing up for insurance stat?

The blaze at the 75-storey Sulafa Tower gripped the city on Wednesday, as the fire reportedly started on the 60th floor, before it rapidly spread to the 70th.

Flaming debris which fell on balconies underneath then caused the inferno to spread from the 35th to the 45th floors.

Luckily a quick response from residents and the Fire Service meant no one was injured, but some residents are not allowed back into their smoke-damaged and flooded home for the time being.

READ MORE

*No health insurance? No Dubai residency visa*

*One man lost Dhs1.3 million worth of art in The Address fire*

*Torch Tower fire: How Dubai rallied round stricken residents*

And worryingly, 86 per cent of UAE residents do not have home contents insurance according to an article by Good last year.

Of the people surveyed, 52 per cent didn’t see cover as a priority, and 10 per cent said they didn’t even know how to get it.

A handy guide to home contents insurance

While the UAE does enjoy relatively low crime rates compared with the rest of the world, what about the risk of fire, flooding, or (horror of horrors) a broken AC unit? The experts at UAE comparison website Souqalmal.com explain to Good what is covered by home contents insurance, why you should consider it, and how to get it.

Isn’t my landlord responsible for insurance?

The owner should insure their property, and it’s a legal requirement

if the property is mortgaged, but it is the responsibility of the tenant to insure their own items. It’s not compulsory, but if you add up the cost of replacing everything you own you might be surprised just how much it is all worth. When renting, the tenant should check that the landlord is properly insured too.

Why should I get home contents insurance?

No one knows what risks are around the corner and while burglary is rare in this part of the world, it does happen. There is also the risk of fire to consider. Even minor smoke damage can ruin your possessions.

Who offers home contents insurance?

There are a number of insurance companies offering various plans. One option is to use an expert broker, who will have access to more providers than an individual and save you time, as well as making sure you take the most appropriate cover.

How do I take it out?

You can approach an insurance company directly, speak to a general insurance broker or use the comparison tool on Souqalmal.com to view different plans via the approved broker. Enter your requirements and you will be contacted with an outline of prices and options on the same day.

What should I do if I want to make a claim?

Before you even take out the policy, make sure you read the small print to make sure you are getting the cover you want and need. Be aware of the policy limits and restrictions and whether there is an excess amount (also known as a deductible), the relatively small initial sum which is not covered by the insurer and which you pay. If you need to make a claim, contact the insurance company immediately, advising them of the situation. You may need to provide a police report for items that are stolen or receipts for items to be replaced.

Can I get a discount?

You might be eligible for a discount if you have a car insurance policy with the same provider.

Contents insurance: The facts

1. All valuables are covered – even outside the home. Home contents insurance covers all of your valuables, even if you lose them while you are outside of your home. So yes, your mobile phone is covered too.

2. Landlord liability is included. Contents insurance will usually cover you against the liability to your landlord.

3. It’s speedy! The process of buying home insurance can be completed in just 48 hours.

4. Different policies are available. Home insurance policies are available in three forms;

– Personal belongings – Only ‘moveable’ items such as jewellery and mobile phones.

– Contents – Existing content in the household, including furniture, clothes, televisions and other electrical goods.

– Building – Insurance cover on the actual villa or apartment, if you are a landlord.

You can also opt to include accidental damage cover.

5. Many plans cover more than you think. Home insurance policies can be tailored to include:

– Loss of rent: As a landlord, some policies cover your loss of rent while property is damaged.

– Alternative accommodation: Your insurance can provide you with alternative accommodation while repairs on your home are taking place.

– New for old replacement: Should your items be damaged due to an incident in the home, you can replace the items based on the value they were when you purchased them, as opposed to their current market value.

– Domestic help: You can choose to cover your domestic help for accidental medical expenses, disability or death.

How to avoid the need to make a claim

From blocked drains to malfunctioning AC units, there’s a lot that can go wrong with your property. Instead of waiting until you have a fully-fledged problem on your hands, try adopting a proactive, rather than reactive, approach to property maintenance.

In the UAE your home insurance policy does not cover problems caused by not looking after the property properly. While some landlords cover the cost of regular maintenance, not all do, so it’s often up to the tenant to maintain the property. These tips will help you keep your home in good condition and avoid an unwelcome maintenance bill.

Keep drains unclogged

– Place strainers over all plugholes to prevent hair and other debris clogging your drains.

– Avoid pouring grease down your kitchen sink as this will congeal in your pipes.

– Pour boiling water down your drains regularly. Once a week, pour a cup of distilled white vinegar or baking soda mixed with hot water down your drains.

_ Have a plunger and liquid drain cleaner handy in case you notice that your sink isn’t draining properly. Addressing property issues immediately can help you avoid expensive call outs.

Maintain your AC

Given our reliance on air conditioning here in the UAE, maintenance should be a top priority. Get your AC unit serviced at least once a year. This will cost around Dhs300 to Dhs1,000 depending on the size of the property and the number of units that need to be serviced. Renters should check their contract to see if the landlord is responsible for AC maintenance.

Keep pests at bay

The warm climate presents ideal breeding conditions for a number of pests, particularly flying insects, and good hygiene and effective housekeeping are your first line of defence.

– Empty bins regularly.

– Don’t leave food out on counters.

– Seal holes in skirting boards or between tiles with silicone.

– Attach bristle strips to the bottom of doors.

– In the garden, cut back hedges and bushes and clear away piles of leaves.

– Wash bed linen regularly (at 60ºC or above) and hoover your mattress to keep bed bugs at bay.

Manage the mold

Mildew is unhealthy as well as unsightly. The fungus-like organism can grow on any damp, flat surface, so keep an eye on tiles, windowsills and ceilings. Remember to air out your bathroom after every shower, and dry laundry and towels thoroughly after washing. If you do come across mildew, clean the affected area with undiluted bleach straight away.

Guard against flooding

Going on holiday? Make sure you don’t have to wade through your living room upon your return.

– Inspect all taps for leaks.

– Turn off appliances.

– Turn off washing machines and dishwashers and tightly close all taps, as well as the toilet hoses.

_ Turn off the water supply. Most properties have a water meter with a dial – a moving dial indicates that water is still running somewhere in the house. Your building maintenance team can help you locate the meter.

– Ask a neighbour or nearby friend to pop in while you’re away to check on things.

What to consider when weighing up insurance

Assume nothing. Don’t dismiss the possibility of insuring your home and contents based on price. The insurance sector is a competitive one and for as little as Dhs21 a month you can protect your belongings and get peace of mind without breaking the bank.

Insurance is not just for homeowners. Just because you do not own your own property, you still need to safeguard against liability from landlords, neighbours or other third parties in case of an accident. Don’t assume that your landlord will look after you.

Only a call away. The benefit of insurance means that in the event of a disaster, you’re only a phone call away from help. An insurer can focus on getting you and your family re-housed in times of emergency or simply fixing the damage to your home and returning you to normal family life, without worrying about the financial side.

Any time, any place. Don’t put off insurance because you are considering moving home this year. Some insurance policies even cover you for accidental loss or damage to your contents while they are in transit by land by professional removal contractors from your existing home to your new home (provided both homes are in the UAE).

An unoccupied home. The right insurance policy can also protect your belongings when you are out of the country. For those who spend the summer outside the UAE or travel extensively throughout the year, 60 days unoccupied cover is also an option worth exploring as part of your insurance package. This way, you are free to enjoy some well-earned R&R without worrying about the home you left behind.

Always read the small print. Some of the lesser-known benefits of insurance that come as part of your policy can include practical help with things such as the installation of locks and keys to external doors and replacement of stolen keys. Always read your policy closely to ensure you are making the most of your investment and saving yourself time and money.

Don’t underestimate what you can protect. The beauty of insurance is that it can be tailored specifically to your needs. If you have a large family it may be worth looking at the small print of an insurance policy as some cover eventualities that you never even considered, such as the loss or damage of food in a domestic deep freezer caused by a rise or fall in temperature.

– For more about Dubai straight to your newsfeed, follow us on Facebook.

Images: Getty