Never want to go to a bank branch in Dubai again? This is a game changer

Sponsored: Everything you need from this bank you can do on your phone (and they’ll give you 2.5 % p.a. interest on your hard-earned savings).

We’re going to be totally honest, going to the bank in Dubai isn’t our favourite way to spend our free time.

Well, there’s a new player in town that has taken banking entirely into the digital realm – with no need to visit a branch and no need to wait in line, ever.

You just need to earn at least Dhs10,000 a month to sign up (but there are no minimum balances) – and if you do it will completely change the way you bank (all other industries are changing at a rapid pace, so it’s about time banking did too).

CBD NOW (which is powered by the Commercial Bank of Dubai and was founded in 1969) is kickstarting the digital banking revolution in Dubai. They asked thousands of people what annoyed them about banks in the UAE, and how they wanted their bank to work for them. And, after months of feedback, CBD NOW made the best ideas from the community happen.

Here’s what banking with them means…

You can do EVERYTHING you need to do on your mobile phone (24 hours a day): No waiting in line, no leaving your house. You can upload documents like your Emirates ID all within the mobile app. Job done. You don’t even have to phone them up (because, let’s be honest, call centres can be infuriating at times too).

*You can join the bank by downloading the app here*

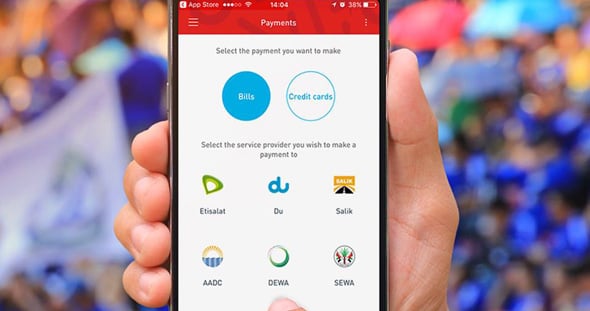

All payments can be made virtually (and instantly): Line up every month to make your remittances? You don’t need to. You can make all payments virtually and easily within the app, and can make international transfers back home anytime.

2.5% p.a. interest on savings: The Save NOW account will give you 2.5% p.a. interest on your savings for the first nine months (that’s comparable to the top savings accounts in many other countries). The best bit is there are no restrictions – you can move your money in and out of the account whenever you want without losing out on your monthly interest.

And lower interest on your credit card: The Visa Signature Credit Card has a 0% interest and no fees for 12 months on balance transfers, with a 2.99% interest rate on purchases.. They also offer easy 0% payment plans.

There’s even interest on your normal account: The day-to-day current account you will use every day even gives you interest for every dirham you earn – you’ll earn up to 0.75% interest on that money with no hassle at all. It looks like the money saved on branches will pay off for the customer.

Get a free ‘lifestyle’ experience: For a limited time only anyone who signs up to the bank and gets a debit card through them will get a voucher for a Dhs300 ‘lifestyle experience’ in Dubai – meaning you can try anything from watersports to driving experiences, entirely free.

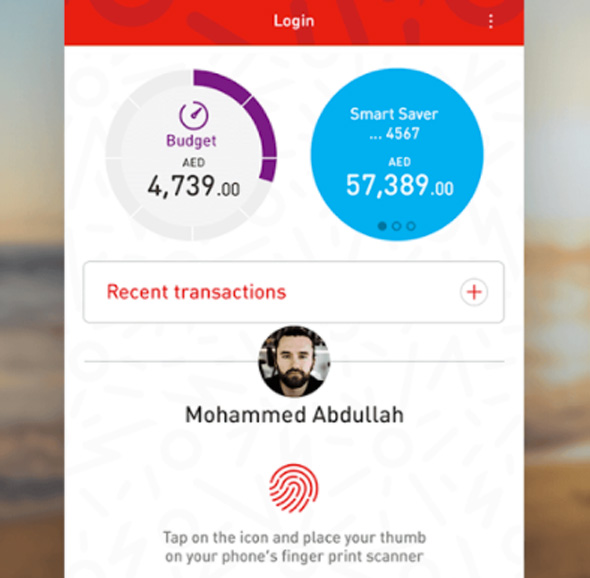

Smart mobile notifications to help you keep on budget: Algorithms aren’t just built to tell you what to watch on Netflix – oh no. CBD NOW say they can actually help you gain control of your financial world by sending you smart notifications to remind you to keep on budget track (we certainly need that). You can get bill reminder notifications and view your spending by category (to see where you could tighten your belt a bit).

There are loads of discounts for customers too: From 50% off at VOX cinemas to discounts at restaurants and waterparks, within the CBD NOW app you can search for discounts near you and redeem them instantly. No hassle.

Here’s a simple tutorial guide to the app…

There are in-built budget tracking tools: The Budget and Expense tracker tool are simple, well-designed ways to track your savings and spending.

No waiting: Want to sign up? You’ll get your debit card within 24 hours of applying to the bank. Not bad at all.

Join the bank by downloading the app – click this link to do so. And you can read more about the bank at the website here.